High interest rates bring balance after years of housing overspending

[ad_1]

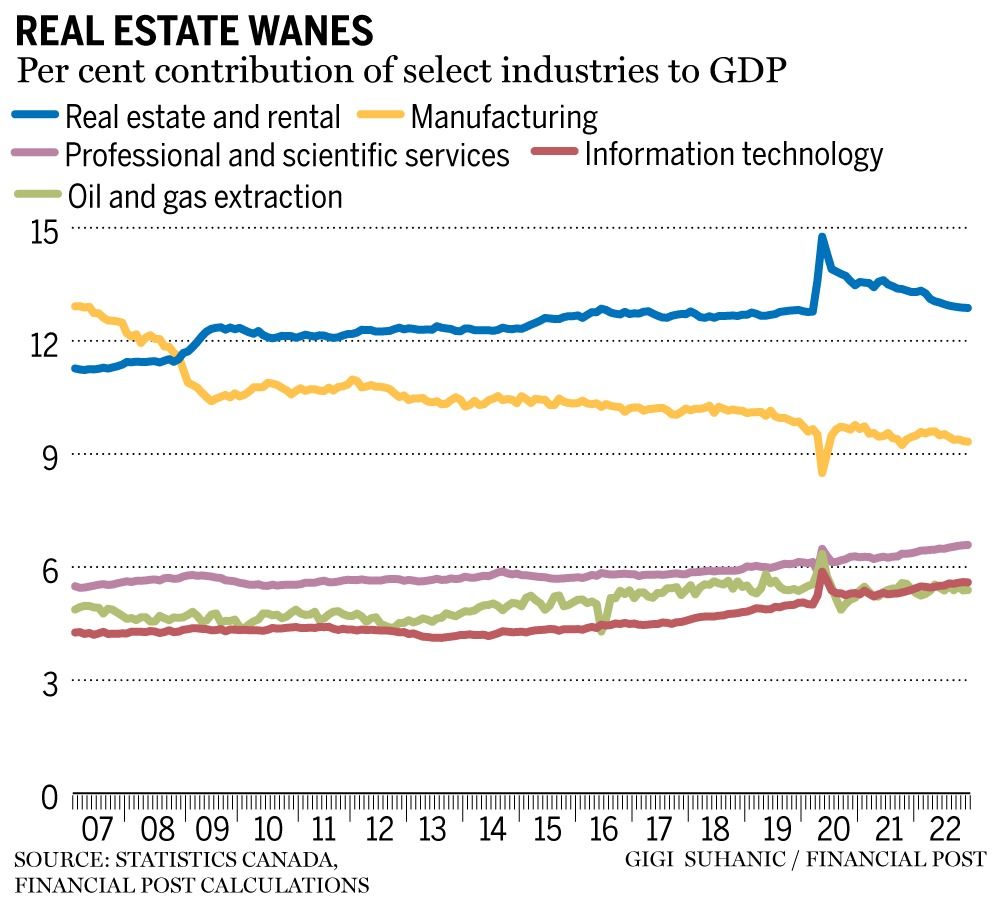

Industries that will be key to future growth claiming a bigger share of the economy as housing slows

Article content

Higher interest rates hurt, but they might be bringing some balance to Canada’s economy after years of overspending on housing.

Advertisement 2

Article content

Statistics Canada reported Jan. 31 that gross domestic product increased 0.1 per cent in November from the previous month, evidence the economy was approaching stall speed at the end of the year, just as the Bank of Canada predicted it would be.

Article content

It was the weakest month-to-month increase since January of last year, and there’s little reason to anticipate a re-acceleration in December. Statistics Canada said preliminary data suggest GDP was unchanged last month, which implies the economy grew at an annual rate of 1.6 per cent in the fourth quarter, according to Bank of Montreal chief economist Douglas Porter.

Article content

That would be a slightly faster pace than the 1.3 per cent rate the Bank of Canada predicts in its latest economic outlook, but still considerably slower than the 2.9 per cent rate of the third quarter and the 3.2 per cent rate of the first quarter. The Bank of Canada’s interest rate increases — four percentage points between March and December with an additional quarter point lift last week — are starting to bite.

Advertisement 3

Article content

“Growth has come to a crawl,” Charles St-Arnaud, chief economist at Alberta Central, said in a note to his clients.

Canada is coming off a long high of housing-led growth. It’s fun for a while, especially for those who thought they had purchased a place to live only to discover they are sitting on fortunes.

Population growth and limited supply were responsible for some of the demand that drove housing prices to rare heights over the past decade, but much of it was caused by ultra-low interest rates and a decision by households to pile up dangerous levels of debt. Now, interest rates are higher than some new homebuyers have ever seen, and the housing bubble is deflating. One of the main causes of the decline in GDP in November was residential building construction, which dropped 1.8 per cent, the seventh decline in eight months and the biggest since unionized construction workers went on strike in May 2022.

Advertisement 4

Article content

Canada could have used two periods of ultra-low interest rates and extraordinary levels of fiscal stimulus to turn itself into a modern economy. And perhaps it took some steps in that direction, as some of that money will have sloshed into productive enterprises and provided backing for some talented entrepreneurs. But mostly we bought existing homes and condos, enriching the real estate industry, perhaps the least productive sector in the economy.

A notable moment in Canadian economic history occurred in December 2008. As the Great Recession gathered force, and central banks pushed borrowing costs to zero, Canada’s “real estate and rental and leasing” industry generated output equivalent to 11.7 per cent of GDP, surpassing the contribution from manufacturing for the first time, according to Statistics Canada data.

Advertisement 5

Article content

The country’s brokers, agents and landlords didn’t look back. Their share of GDP climbed to 14.8 per cent in April 2020, when many other industries were forced to shut down, and central banks had once again dropped interest rates to essentially zero to stave off deflation in the early days of the COVID-19 crisis. (Manufacturing was 8.5 per cent.)

Bank of Canada governor Tiff Macklem told the House finance committee in November that he intends to conduct an analysis of how monetary policy was deployed during the pandemic. The central bank for the first time used quantitative easing (QE), an approach to stimulus that involves creating money to purchase financial assets. Macklem was among the most active users among the major central banks, and it’s fair to wonder whether he was too active, given the additional froth that was whipped up in housing markets. Shelter costs were an important contributor to the inflation surge that prompted the most aggressive series of interest rate increases in the Bank of Canada’s history.

Advertisement 6

Article content

Canada’s central bankers dislike taking responsibility for what happens at the micro level in the economy, saying their only job is to keep inflation at around two per cent. That’s true, but the problem with that dodge is that there is now sufficient real-world evidence to suggest that the distortions created by zero interest rates should be considered against the desire to achieve a certain inflation target.

In some ways, last year wiped out more than a decade of such distortions. The benchmark interest rate is now back to where it was in 2008, before the Great Recession. And perhaps as a result, economic gravity is reasserting itself.

Manufacturing probably never will be the economic engine it was a generation ago, but at 9.4 per cent of GDP, it’s still below its pre-pandemic level of around 10 per cent. There’s room to grow, although higher borrowing costs and an economic downturn will make that harder in the short term.

Advertisement 7

Article content

A more positive sign is that a couple of industries that will be key to future growth — and probably geared to structural changes in the economy rather than short-term interest rates — continue to claim a bigger share of the economy.

-

![A condo building is seen under construction surrounded by houses in Vancouver, B.C., on Friday March 30, 2018. Canada's banking regulator is expected to make an announcement regarding the interest rate used in a key stress test for uninsured mortgages this morning. THE CANADIAN PRESS/]()

Homeowners now better positioned to weather a downturn than a decade ago, report argues

-

![Bank of Canada governor Tiff Macklem went out on his own in July when he raised the benchmark rate a full percentage point. Now he has been the first to press pause.]()

Kevin Carmichael: Bank of Canada emerges as the trendsetter on interest rates

-

![None]()

Kevin Carmichael: Bank of Canada needs deeper post-mortem of what went wrong on inflation

-

![Employment in Canada rose by 104,000 jobs in December, and the unemployment rate declined 0.1 percentage points to 5.0 per cent.]()

Interest rates headed higher after Canada’s job gains blow past expectations

Companies that provide services related to information technology — think Montreal-based CGI Inc., which builds computer systems for companies and governments — now generate about 5.6 per cent of Canada’s GDP, more than oil and gas and the most since Statistics Canada started measuring the industry’s output in 2007, when the percentage was about 4.3 per cent.

Advertisement 8

Article content

And at the higher end of what is very loosely described as the innovation economy, companies that provide professional, scientific and technical services generated output worth $136.8 billion in November, the equivalent of 6.6 per cent of Canada’s $2.1-trillion economy and a record.

Combined, IT services and professional and technical services now account for about 12 per cent of the economy. That’s getting close to real estate, which has dropped to 12.9 per cent, the lowest since February 2020. So, we’ve almost worked off the excesses of one crisis. Real estate represented about 11.4 per cent of GDP in early 2008. There’s still some rebalancing to do.

• Email: kcarmichael@postmedia.com | Twitter: carmichaelkevin

[ad_2]

Source link

Comments are closed.